Full question:

If a non US citizen does not have a social security number or work visa can they submit a Individual Tax Identification Number (ITIN) or (TIN) in its place to an employer? If said individual plans on obtaining a work visa at a later date will using a TIN to obtain employment hinder this process. If said alien cashes checks issued to them by employer using a ITIN or TIN, and without a work visa what legal repercussions from the US government, if any, can individual expect to encounter?

- Category: Employment

- Date:

- State: New York

Answer:

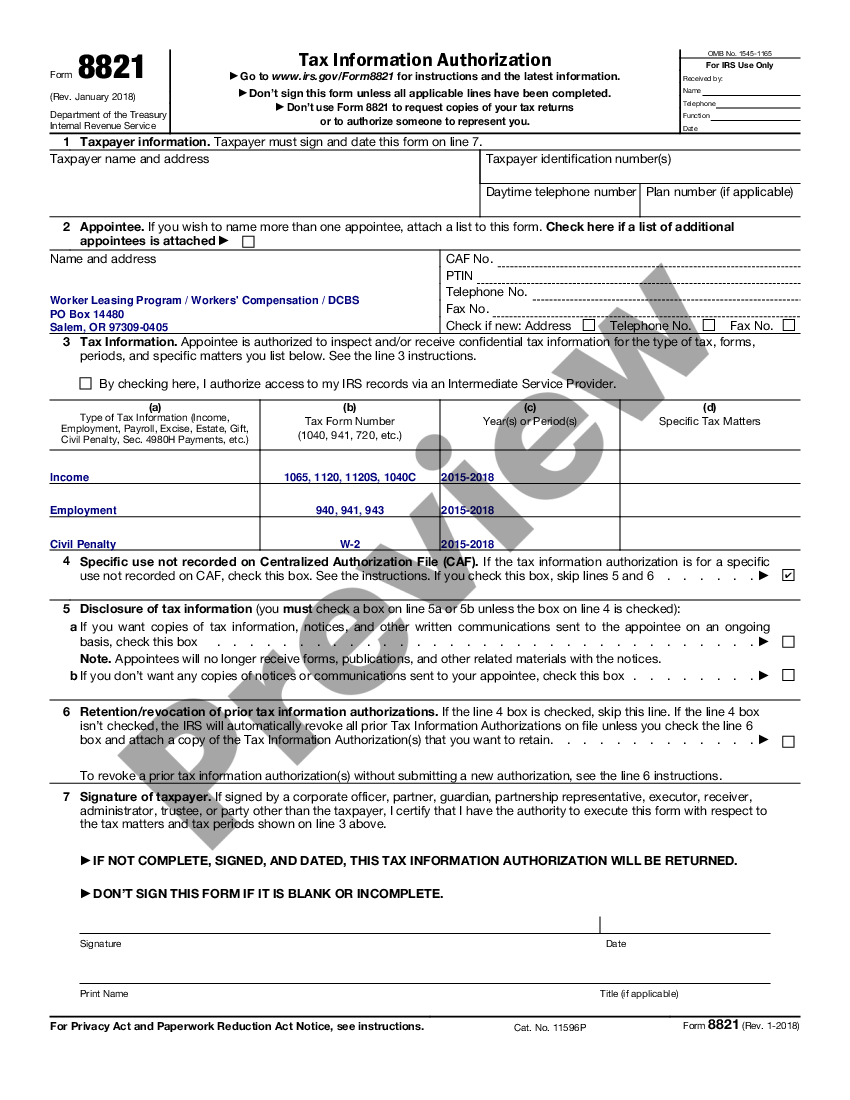

An employer should not accept an ITIN in place of an SSN for employee identification or for work. An ITIN is only available to resident and nonresident aliens who are not eligible for U.S. employment and need identification for other tax purposes. An individual with an ITIN who later becomes eligible to work in the United States must obtain an SSN.

Consequences will depend on the facts in each case. Some of the possible consequences may include, among others, deportation, fines, or fraud-related charges. I suggest you consult with a local immigration attorney who can review all the facts and document involved.

This content is for informational purposes only and is not legal advice. Legal statutes mentioned reflect the law at the time the content was written and may no longer be current. Always verify the latest version of the law before relying on it.